An Increase in the Expected Inflation Rate Will

Economics questions and answers. Loans have just become cheaper in real terms while the current purchasing power they represent has not been affected.

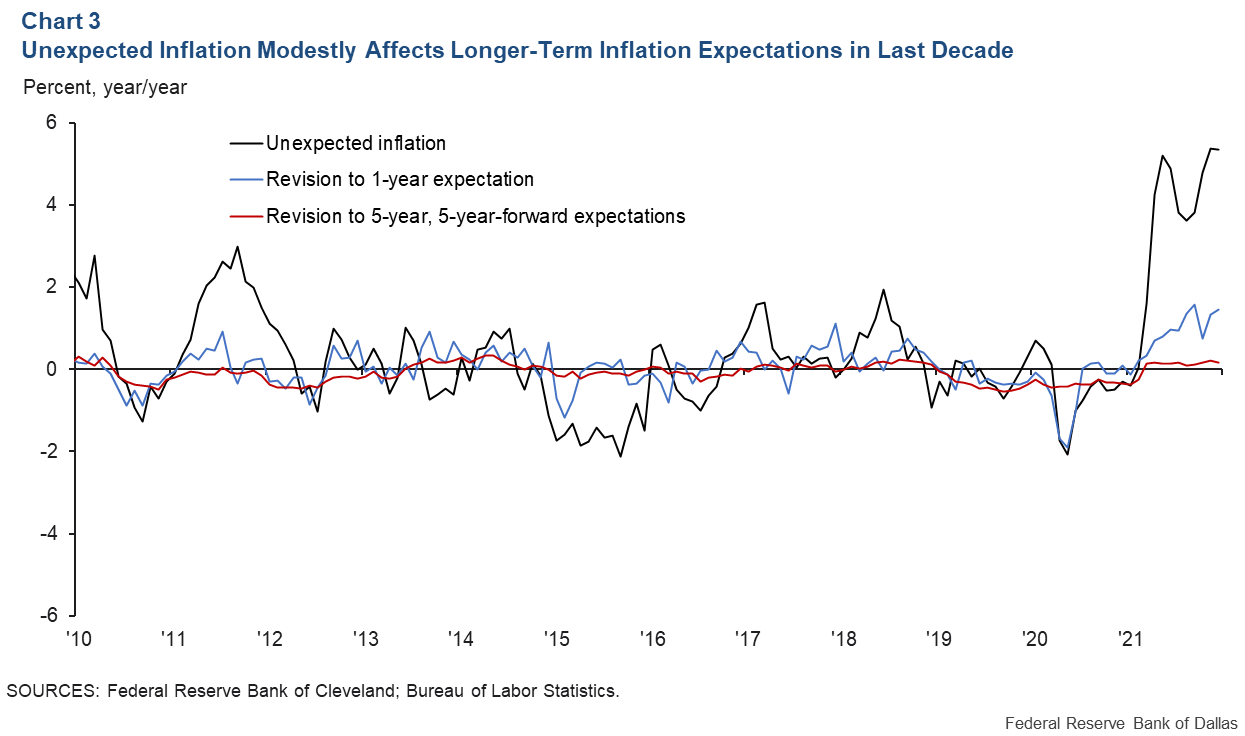

Recent Inflation Surges Have Modestly Affected Long Term Expectations Dallasfed Org

Inflation continues to rise and the Federal Reserve is expected to start taking action to combat it with a quarter-point rate hike next week.

. Are falling in price after data showing inflation was stronger than expected in. 13 hours agoThe increase was driven by a 25 percent increase in the price of dairy a 20 percent increase in nonalcoholic beverages and a 103 percent increase in the cost of eggs as avian flu decimated. An increase in expected inflation will cause the economys aggregate demand curve to.

An economist favoring an active approach who observes a drop in real GDP. In March consumer. The Fed is expected to raise its benchmark interest rate by half a percentage point on Wednesday as the rate of inflation driven largely by jumps in energy and food prices continues to grow.

The recent broadening of inflationary pressure has coincided with a notable pickup in rental inflation said Peter B. Shift the short run Phillips curve upward b. Decrease the expected returns on bonds.

McCrory economist at JPMorgan which jumped to its highest monthly rate in. Not shift the short-run Phillips curve unless the unemployment rate changes. Before any re-equilibrium effect a rise in expected inflation reduces the real interest rate that prospective borrowers face.

Phillips curve shift the short-run Phillips curve to the left. For the month this index went up 05 percent. Consumer prices have been rising at the fastest pace in 40 years.

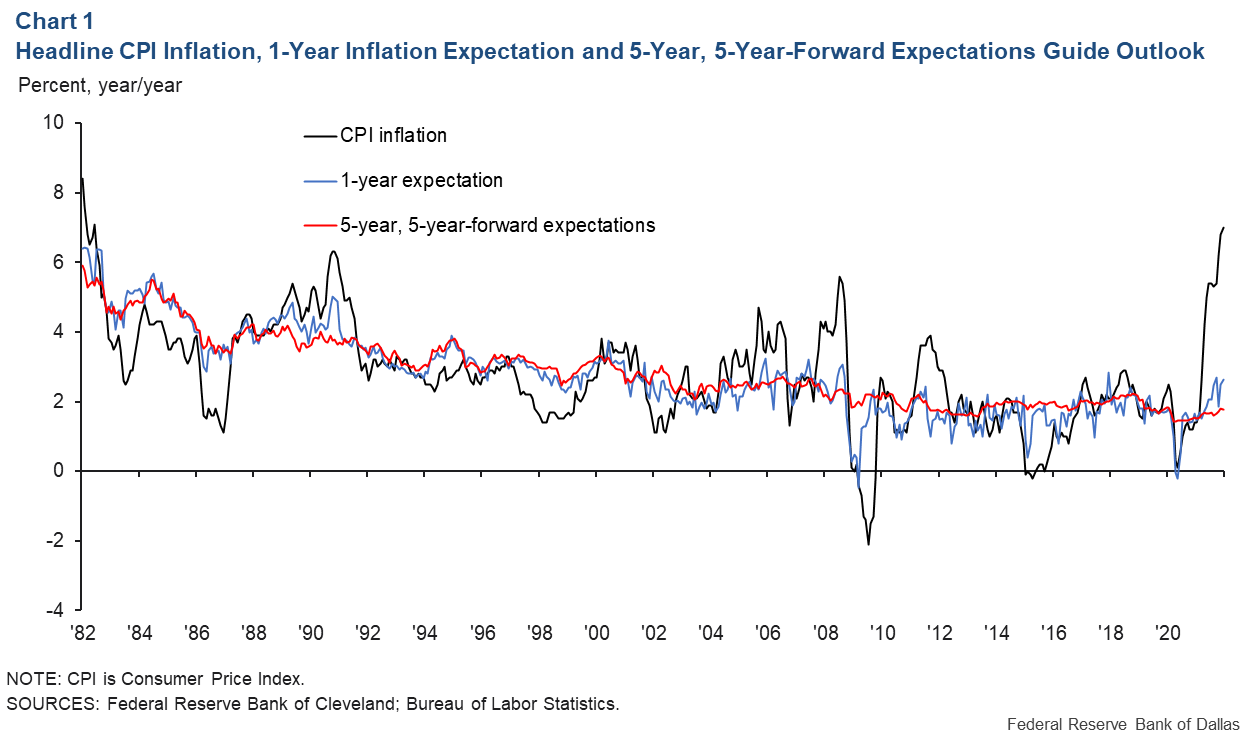

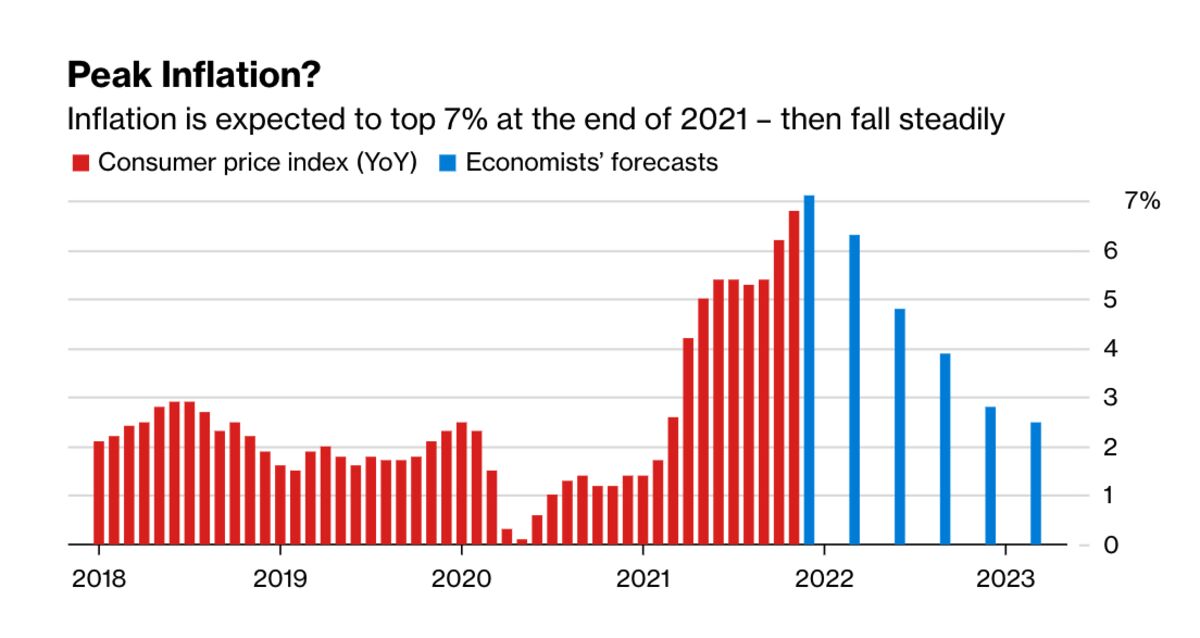

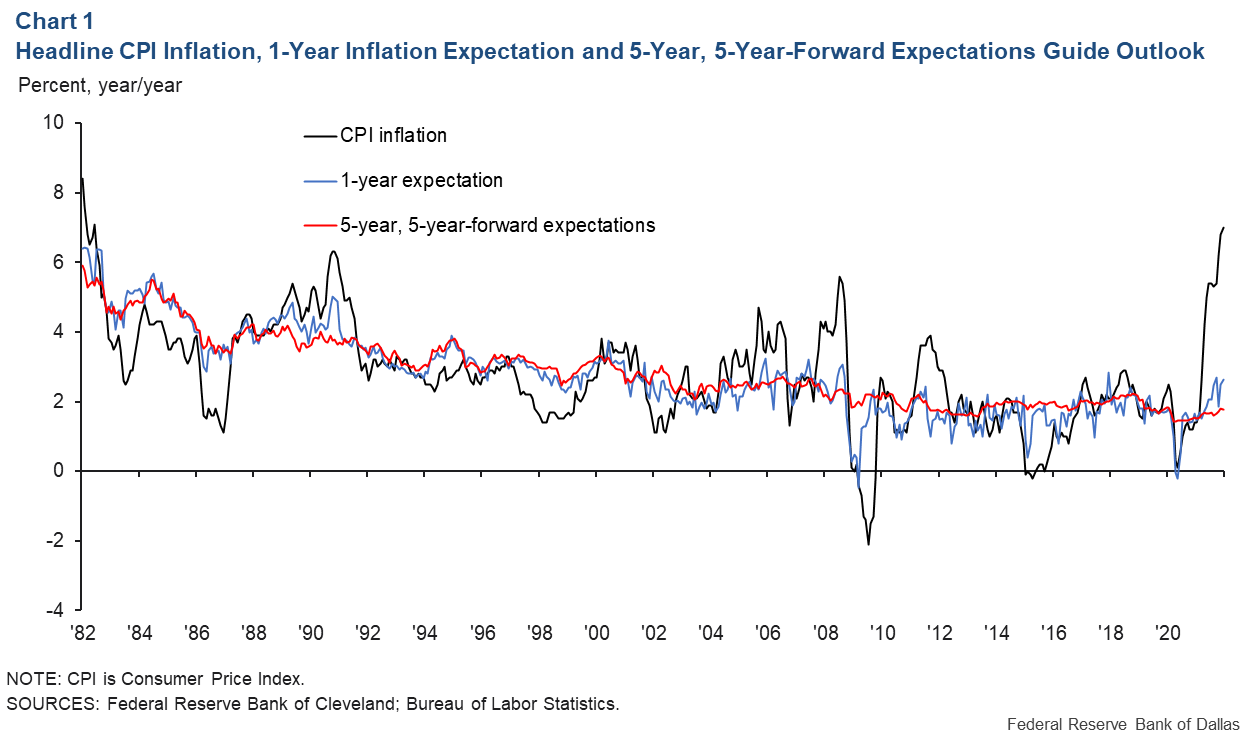

March 18 2022 The Federal Open Market Committee FOMC in its latest meeting on March 16 2022 forecasted that the Personal Consumption Expenditures PCE inflation rate in the United States will average at 43 in 2022 and then decline to 27 in 2023. The shifts shown in the short-run and long-run Phillips curves between period 0 and period 1 could be explained by. This is likely to be the peak for the year.

The surge in gasoline prices in March boosted annual inflation to 85 the highest in 40 years. But it was Fed Chairman Jerome. The FOMC the US Federal Reserve Systems monetary policymaking body which seeks to foster price stability.

Have no effect on the expected returns on bonds. An increase in the expected rate of inflation will. Economics questions and answers.

An increase in the expected inflation rate will cause the long-run Phillips curve to shift to the left short-run Phillips curve to shift to the left actual inflation rate to fall below the expected inflation rate long-run Phillips curve to shift to the right Short-run Phillips curve to shift to the right Question 18 1 point The economy is currently in. Remained unchanged If wages are not as flexible as prices in the AD. Februarys CPI was a hot 79.

Tend to increase production unless the actual inflation rate also increases. On Wednesday central bank officials approved a half-percentage-point interest rate increase lifting the federal-funds rate to a target range between 075 and 1. The Federal Reserve raised interest rates by half a percentage point Wednesday in an effort to cool off demand and lower inflation.

It defines the latter as an annual inflation rate of 2 percent on average. The 50-basis-point increase is the biggest increase the rate-setting FOMC has instituted since May. A decrease in expected inflation rate will.

Cause no shift in the Phillips curve d. Last October the COLA for 2022 was announced. Cause the unemployment rate to increase 13.

To help achieve that goal it strives to anchor inflation expectations at roughly 2 percent. A consol or a perpetuity is a bond. Increase the expected returns on bonds.

Refer to Figure 16-1. 7 hours agoInflation Rate and 2023 COLA Prediction of 89. Cause the unemployment rate associated with each inflation rate to decrease.

Core inflation excluding food and energy is expected to rise a half percent the same as February with a year-over-year gain of 66 up. This is when economic growth is positive with a healthy 2 rate of inflation. Shift the short-run Phillips curve upward and to the right.

If actual inflation is. For federal employees who have retired or are planning to retire The Consumer Price Index for Urban Wage Earners and Clerical Workers CPI-W increased 89 percent over the last 12 months. The rate move is the largest since 2000 and is in response to burgeoning inflation pressures.

Shift the short-run Phillips curve downward aund to the left c. An increase in the expected inflation rate will a. 2 hours agoSome on Wall Street think Wednesdays CPI report puts a 75-basis-point interest-rate increase back on the table.

That has no maturity date. The key to understanding the short-run trade-off behind the Phillips curve is that an increase in inflation will decrease unemployment if the inflation is _____ by both workers and firms. An increase in the expected inflation rate will a.

An increase in the. Increase the demand for bonds. They may pay the same nominal interest rate but the financial burden is smaller due to the inflationary expectations.

That has no repayment of principal.

U S Inflation 2022 The Clashing Forces That Will Drive Consumer Prices Bloomberg

Consumer Inflation Expectations Hit Eight Year High In Fed Study Bloomberg

Recent Inflation Surges Have Modestly Affected Long Term Expectations Dallasfed Org

No comments for "An Increase in the Expected Inflation Rate Will"

Post a Comment